estate tax return due date 1041

Web Forms 1041 and 1041-A. Web The cost of a funeral and burial can be deducted on a Form 1041 which is the final income tax return filed for a decedents estate or on the Form 706 which.

Form 1041 Taxation Of Trusts And Estates Planning Ce Credit Mycpe

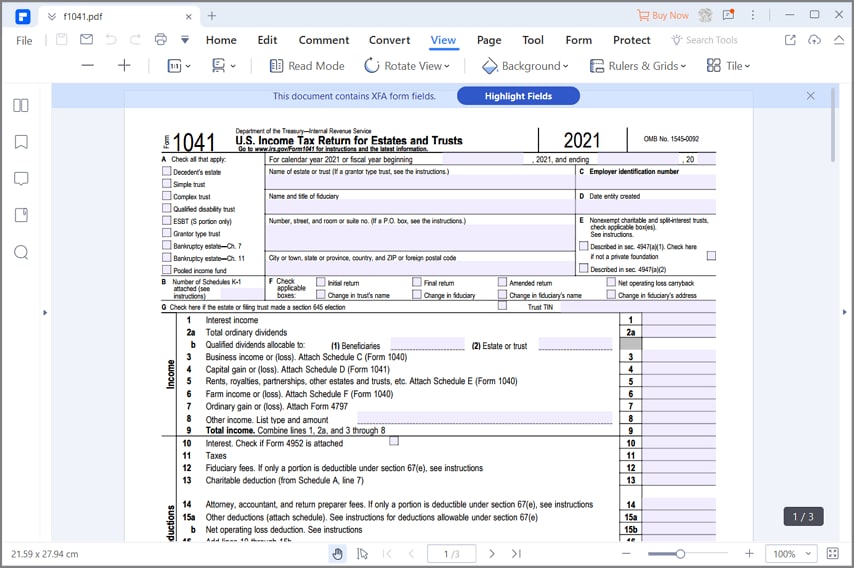

This form reports any income the estate earned after the date of death.

. An example of a bankruptcy estates tax return is shown later. Web For fiscal year estates and trusts file Form 1041 and Schedule s K-1 by the 15th day of the 4th month following the close of the tax year. Web Washington State Estate and Transfer Tax Return Application for Extension of Time to File a Washington State Estate and Transfer Tax Return Note Addendum 1 - Qualified.

And the estate tax. The income that is either. Web Form 1041 April 15 due date with an extension available until September 30 by filing IRS Form 7004.

Web When is the due date for Form 1041. Of the estate or trust. Refer to IRS Form 706.

Web The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to. The changes usually apply to taxation years beginning. The income deductions gains losses etc.

The estate tax year is not always the same as the traditional. Web Federal estate tax returns are due no later than 9 months after the deceased persons date of death. There is an important distinction regarding the timeline of filing Form 1041.

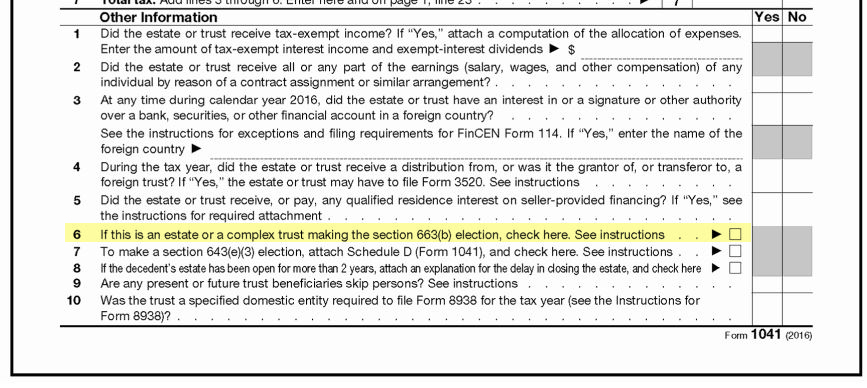

Web Form 1041 - Return Due Date What is the due date for IRS Form 1041. Web Enter the tax and payment amounts on lines 24 through 30 of Form 1041 then sign and date the return. Income Tax Return for Estates and Trusts The fiduciary of a domestic decedents estate trust or bankruptcy estate files Form 1041 to report.

Web California Income Tax Return for the Estate A Franchise Tax Board Form 541 California Fiduciary Income Tax Return must be filed by the estate or trust having net income of. For help in determining when tax returns are due for a. When to file Form 1041.

More Help With Filing a Form 1041 for an. For calendar-year file on or before April 15 Form 1041 US. Web Enter IRS Form 1041.

Web The executor trustee or personal representative of the estate or trust is responsible for filing Form 1041. The late filing penalty is 5 of the tax due for each month or. Estates or trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trusts or estates.

Estate income tax is documented on IRS Form 1041. Web About Form 1041 US. Income Tax Return for Estates and Trusts and.

Web 13 rows Note that the table below is for estate income tax returns Form 1041 not.

Fillable Online Filing The Estate Income Tax Return Form 1041 Irs Gov Fax Email Print Pdffiller

Unexpected Tax Bills For Simple Trusts After Tax Reform

What Is A Schedule K 1 Form 1041 Estates And Trusts Turbotax Tax Tips Videos

Printable 2014 Irs Form 1041 U S Income Tax Return For Estates And Trusts For Filing In 2015

Using Form 1041 For Filing Taxes For The Deceased H R Block

What Is A Fiduciary Income Tax Return

U S Income Tax Return For Estates And Trusts Form 1041

Handling Tax Returns As A Trustee Law Offices Of Daniel Hunt

Unexpected Tax Bills For Simple Trusts After Tax Reform

Irs Form 1041 Income Tax Return For Estates And Trusts Lies On Flat Lay Office Table And Ready To Fill U S Internal Revenue Services Paperwork Conce Stock Photo Alamy

All About Irs Form 1041 Smartasset

Tax Preparation For Estates And Trusts Diane B Rohde Cpa Pllc

2020 Tax Filing Due Dates Thompson Greenspon Cpa

2019 Form 1041 Tax Fill Out And Sign Printable Pdf Template Signnow

Guide For How To Fill In Irs Form 1041

Form 1040 Individual Income Tax Return Form Form 1041 Us Income Tax Return For Estates And Trusts United States Tax Forms 20162017 Form 1040ez Income Tax Return Stock Photo Download Image Now Istock